Introduction

Cash flow is the lifeblood of any business. It is the amount of money that flows in and out of the business, and it is essential to its survival.

A healthy cash flow means the business can pay its bills, invest in growth, and weather unexpected expenses. However, when there is tight or negative capital, businesses can experience real pain.

The Importance of Cash Flow

Cash flow is critical for businesses because it affects their ability to operate and grow. A positive turnover enables a business to:

- Pay bills and meet its financial obligations

- Invest in new equipment or technology

- Hire new employees or give raises

- Expand into new markets or geographies

- Take advantage of unexpected opportunities

Causes of Cash Flow Problems

There are several reasons why a business may experience cash flow problems, including:

- Slow-paying customers

- Overhead expenses that are too high

- Unexpected expenses, such as repairs or legal fees

- Seasonal fluctuations in demand

- Inefficient or ineffective cash management practices

The Impact of Cash Flow Problems

When a business experiences cash flow problems, it can have several adverse effects:

- Unable to pay bills or make payroll

- Late payments to suppliers, which can damage relationships

- Reduced ability to invest in growth or take advantage of opportunities

- Increased stress on business owners and employees

- Possible legal or regulatory consequences

Strategies For Improving Cash Flow

There are several strategies that businesses can use to improve their funds:

- Offer early payment discounts to customers

- Negotiate better payment terms with suppliers

- Reduce overhead expenses, such as rent or utilities

- Increase prices or offer premium services to increase revenue

- Implement more efficient cash management practices, such as forecasting and budgeting

The Role Of Financing

Financing can also play a crucial role in helping businesses improve their liquidity. Some financing options include:

- Short-term loans or lines of credit to cover unexpected expenses

- Factoring or invoice financing to access cash tied up in accounts receivable

- Equipment financing or leasing to spread out the cost of expensive equipment

- Merchant cash advances or revenue-based financing to access capital based on future revenue projections

Risks and Considerations

While financing can be an effective way to improve capital, there are also risks and considerations to keep in mind:

- High-interest rates or fees may make financing more expensive than other options

- Depending on the type of financing, it may require collateral or personal guarantees

- Taking on too much debt can hurt the business’s credit score and future borrowing ability

- Failing to repay financing can lead to legal or financial consequences

Case Study: A Business in Pain

XYZ Company is a small manufacturing business struggling with cash flow. They have several slow-paying customers and have had unexpected expenses in the past year, including a broken piece of equipment and a legal dispute with a supplier.

As a result, they have been unable to invest in new equipment and postponed expansion plans.

Solution for XYZ Company

To address its money problems, XYZ Company could consider several strategies, including:

- Offering early payment discounts to customers to incentivise faster payments

- Negotiating better payment terms with suppliers to improve financial resources

- Reducing overhead expenses by renegotiating rent or utilities

- Applying for a short-term loan or line of credit to cover unexpected expenses

- Factoring their accounts receivable to access cash tied up in unpaid invoices.

Conclusion

Cash flow problems can cause real pain for businesses, but some strategies can help. It’s vital for businesses to regularly assess their cash flow and take action when necessary to ensure their financial health.

This may involve implementing more efficient cash management practices, exploring financing options, or making difficult decisions to reduce expenses.

By taking a proactive approach, businesses can improve their cash flow and position themselves for long-term success.

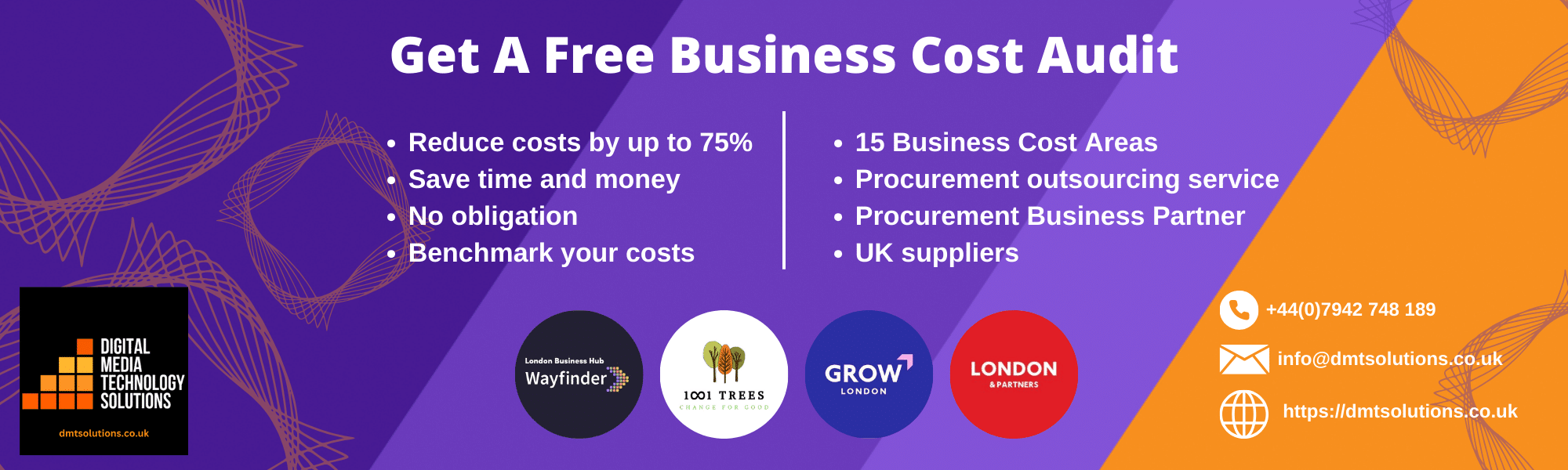

Contact Us for a FREE Business Cost Review. We aim to increase business cash flow by up to 75% within six weeks.